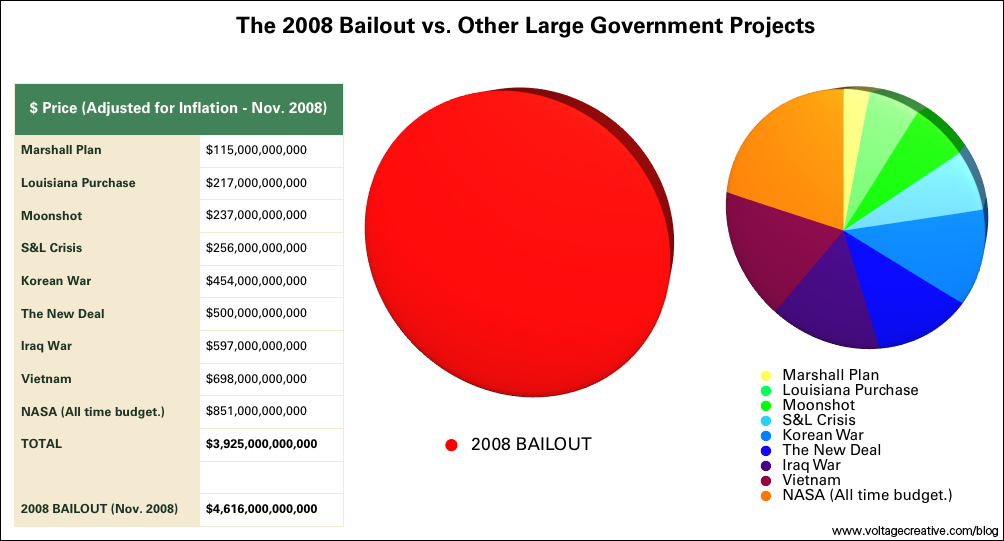

I'm getting more than a little freaked out about the bailouts that are going around. Here's a comparative graph that shows the scale of the U.S. bankingnationalizationbailout:

Disturbing ruminations from FT:

The Bush administration all but nationalised Citigroup, the world’s largest bank. For good measure it threw another, yes another, $800bn into the effort to thaw US credit markets. Everywhere you look, Keynes’s demand management is replacing Adam Smith’s invisible hand; printing money, a mortal sin under the fracturing Washington consensus, is the new prudence.

Something big is happening. What started out as a series of pragmatic ad hoc responses by governments and central banks is moving the boundary between state and market. Politicians are now overlaying expediency with ideology. Government is no longer a term of abuse.

Things could move still faster in the months ahead. With their myriad rescue schemes and loan guarantees, the US and British governments have nationalised their respective banking systems in all but name. The banks pretend they are still answerable to their shareholders, but it is a charade. They survive only with the explicit financial guarantee of the state.

Still, the markets remain frozen, starving business of the oxygen of credit. Unless things change soon, the politicians will have little choice but to take direct control, and quite possibly, ownership, of the banks. Nationalisation could be the first act of an Obama presidency. That at least would put some substance into all those loose analogies with FDR.

Thoughts? There seems to be an orthodoxy that no matter the cost, we must bail out these financial institutions. I don't see this being contested anywhere, which makes me nervous. Was the failure of Lehman really so deadly? Someone please explain to me why we aren't even thinking about allowing some of these banks to go into bankruptcy.

Reply With Quote

Reply With Quote

Bookmarks