Org Mobile Site

Thread: The Bailout

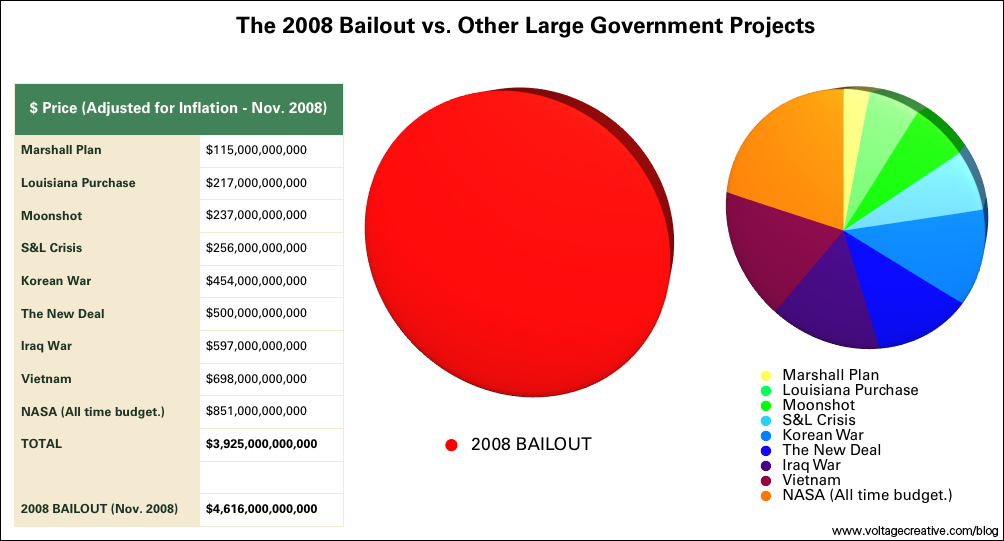

I'm getting more than a little freaked out about the bailouts that are going around. Here's a comparative graph that shows the scale of the U.S. banking nationalization bailout:

Disturbing ruminations from FT:

Thoughts? There seems to be an orthodoxy that no matter the cost, we must bail out these financial institutions. I don't see this being contested anywhere, which makes me nervous. Was the failure of Lehman really so deadly? Someone please explain to me why we aren't even thinking about allowing some of these banks to go into bankruptcy.

Disturbing ruminations from FT:

The Bush administration all but nationalised Citigroup, the world’s largest bank. For good measure it threw another, yes another, $800bn into the effort to thaw US credit markets. Everywhere you look, Keynes’s demand management is replacing Adam Smith’s invisible hand; printing money, a mortal sin under the fracturing Washington consensus, is the new prudence.

Something big is happening. What started out as a series of pragmatic ad hoc responses by governments and central banks is moving the boundary between state and market. Politicians are now overlaying expediency with ideology. Government is no longer a term of abuse.

Things could move still faster in the months ahead. With their myriad rescue schemes and loan guarantees, the US and British governments have nationalised their respective banking systems in all but name. The banks pretend they are still answerable to their shareholders, but it is a charade. They survive only with the explicit financial guarantee of the state.

Still, the markets remain frozen, starving business of the oxygen of credit. Unless things change soon, the politicians will have little choice but to take direct control, and quite possibly, ownership, of the banks. Nationalisation could be the first act of an Obama presidency. That at least would put some substance into all those loose analogies with FDR.

Something big is happening. What started out as a series of pragmatic ad hoc responses by governments and central banks is moving the boundary between state and market. Politicians are now overlaying expediency with ideology. Government is no longer a term of abuse.

Things could move still faster in the months ahead. With their myriad rescue schemes and loan guarantees, the US and British governments have nationalised their respective banking systems in all but name. The banks pretend they are still answerable to their shareholders, but it is a charade. They survive only with the explicit financial guarantee of the state.

Still, the markets remain frozen, starving business of the oxygen of credit. Unless things change soon, the politicians will have little choice but to take direct control, and quite possibly, ownership, of the banks. Nationalisation could be the first act of an Obama presidency. That at least would put some substance into all those loose analogies with FDR.

Thoughts? There seems to be an orthodoxy that no matter the cost, we must bail out these financial institutions. I don't see this being contested anywhere, which makes me nervous. Was the failure of Lehman really so deadly? Someone please explain to me why we aren't even thinking about allowing some of these banks to go into bankruptcy.

Originally Posted by Lemur:

I'm getting more than a little freaked out about the bailouts that are going around. Here's a comparative graph that shows the scale of the U.S. bankingnationalization bailout:

Disturbing ruminations from FT:

It is utterly insane. Our government has totally failed us and ruined us all.I'm getting more than a little freaked out about the bailouts that are going around. Here's a comparative graph that shows the scale of the U.S. banking

Disturbing ruminations from FT:

The Bush administration all but nationalised Citigroup, the world’s largest bank. For good measure it threw another, yes another, $800bn into the effort to thaw US credit markets. Everywhere you look, Keynes’s demand management is replacing Adam Smith’s invisible hand; printing money, a mortal sin under the fracturing Washington consensus, is the new prudence.

Something big is happening. What started out as a series of pragmatic ad hoc responses by governments and central banks is moving the boundary between state and market. Politicians are now overlaying expediency with ideology. Government is no longer a term of abuse.

Things could move still faster in the months ahead. With their myriad rescue schemes and loan guarantees, the US and British governments have nationalised their respective banking systems in all but name. The banks pretend they are still answerable to their shareholders, but it is a charade. They survive only with the explicit financial guarantee of the state.

Still, the markets remain frozen, starving business of the oxygen of credit. Unless things change soon, the politicians will have little choice but to take direct control, and quite possibly, ownership, of the banks. Nationalisation could be the first act of an Obama presidency. That at least would put some substance into all those loose analogies with FDR.

Thoughts? There seems to be an orthodoxy that no matter the cost, we must bail out these financial institutions. I don't see this being contested anywhere, which makes me nervous. Was the failure of Lehman really so deadly? Someone please explain to me why we aren't even thinking about allowing some of these banks to go into bankruptcy.Something big is happening. What started out as a series of pragmatic ad hoc responses by governments and central banks is moving the boundary between state and market. Politicians are now overlaying expediency with ideology. Government is no longer a term of abuse.

Things could move still faster in the months ahead. With their myriad rescue schemes and loan guarantees, the US and British governments have nationalised their respective banking systems in all but name. The banks pretend they are still answerable to their shareholders, but it is a charade. They survive only with the explicit financial guarantee of the state.

Still, the markets remain frozen, starving business of the oxygen of credit. Unless things change soon, the politicians will have little choice but to take direct control, and quite possibly, ownership, of the banks. Nationalisation could be the first act of an Obama presidency. That at least would put some substance into all those loose analogies with FDR.

I'm trying to find a graph that shows the change in GDP over the years.

We still have a healthy GDP compared to national debt. ND has skyrocketed, but not by an absurd margin compared to income. Isn't that important?

The bad part is, we've screwed everyone else with us...

You dirty communists.

Originally Posted by Rythmic:

You dirty communists.

I do feel dirty...You dirty communists.

Our government has sexually assaulted the very meaning of what conservative is supposed to be. Fiscal pragmatism is now dead. The gov't, however, has seeming developed a bad case of necrophelia.

Soon a hammer and sickle will be added to the American flag and the president will grow a beard.

As for us Europeans we will need to ally ourselves with Russia to protect our western values from the new communist threat.

Seriously now, it seems (and this might change) that economies with more sensible forms of capitalism than the US are surviving this much better. The US seems to be trapped into having to save 'too big to fail' corporations and the danger of doing that is the fact that, at the moment, there is nothing better for a big corporation than to fail and get a hand on this sweet juicy stack of government money. But it cannot do otherwise...how can you let the citigroup fail? Someone has to be there to finance the economy when the bears give their place to the bulls.

As for us Europeans we will need to ally ourselves with Russia to protect our western values from the new communist threat.

Seriously now, it seems (and this might change) that economies with more sensible forms of capitalism than the US are surviving this much better. The US seems to be trapped into having to save 'too big to fail' corporations and the danger of doing that is the fact that, at the moment, there is nothing better for a big corporation than to fail and get a hand on this sweet juicy stack of government money. But it cannot do otherwise...how can you let the citigroup fail? Someone has to be there to finance the economy when the bears give their place to the bulls.

Have I missed something?

Wasn't the bailout at 700 milliards (billions for you Americans) + an extra 100 in pork?

How did it grow to 4600 milliards all of a sudden?

Wasn't the bailout at 700 milliards (billions for you Americans) + an extra 100 in pork?

How did it grow to 4600 milliards all of a sudden?

Originally Posted by Lemur:

Thoughts? There seems to be an orthodoxy that no matter the cost, we must bail out these financial institutions. I don't see this being contested anywhere, which makes me nervous. Was the failure of Lehman really so deadly? Someone please explain to me why we aren't even thinking about allowing some of these banks to go into bankruptcy.

Well, banking has been a cornerstone of the economy since about 400-500 years ago, so crashing that system seems to be a generally bad idea.Thoughts? There seems to be an orthodoxy that no matter the cost, we must bail out these financial institutions. I don't see this being contested anywhere, which makes me nervous. Was the failure of Lehman really so deadly? Someone please explain to me why we aren't even thinking about allowing some of these banks to go into bankruptcy.

Originally Posted by Ironside:

Have I missed something?

Wasn't the bailout at 700 milliards (billions for you Americans) + an extra 100 in pork?

How did it grow to 4600 milliards all of a sudden?

My thoughts exactly.Have I missed something?

Wasn't the bailout at 700 milliards (billions for you Americans) + an extra 100 in pork?

How did it grow to 4600 milliards all of a sudden?

Though I did hear about saving the auto industry that didn't seem to amount to that much either.

Originally Posted by Ironside:

Wasn't the bailout at 700 milliards (billions for you Americans) + an extra 100 in pork?

That was one bailout package. It does not include the AIG bailout or the Citigroup bailout, among other things.Wasn't the bailout at 700 milliards (billions for you Americans) + an extra 100 in pork?

I heard a figure on the BBC claiming the final bailout cost for the financial sector alone could come to 8 trillon, that was all the various packages plus some other that where being discussed but not implemented yet...

By the looks on that graph i would reccomend a much bigger version of the marshall plan worldwide (with other rich countrys paying) a huge increase in NASA funding, and simply use the rest to loan to people from the goverment at fixed rates, maybe use some of the money to help reinvent failing car industry's for example, then in a few years maybe banks can step up and start lending money again.... this is probably unworkable but it sounds great in my head...

By the looks on that graph i would reccomend a much bigger version of the marshall plan worldwide (with other rich countrys paying) a huge increase in NASA funding, and simply use the rest to loan to people from the goverment at fixed rates, maybe use some of the money to help reinvent failing car industry's for example, then in a few years maybe banks can step up and start lending money again.... this is probably unworkable but it sounds great in my head...

What a huge mess! We are having deflation, but with government stepping in look for some spin like deflationary-inflation… like the stag-flation of Jimmy Carter’s time.

What is more is that up to 20% of the money goes for bonuses for the top management that created the mess. I think that money would be best spent on jailing the lot of them.

During the Great Depression everyone crashed except Italy. Their dictator of the time called in all the bankers and said…you get the money you need to stay afloat but you tell everyone we are doing fine…no problems, you understand! Italy did fine. Everyone else floundered. Italy was no better off financially than anyone else but people thought they were. It is most perception. That being so…we are shooting our selves in the foot with the whole mess and unless the government does something about the pirates in the Federal Reserve it is not going to get any better. They are bailing out their buddies and the same with the US treasury…talk about a revolving door!

Nationalize the Federal Reserve and have the Government print the money. Perception! Get privet bankers out of the equation, and make the treasury account for where the money is going…secret deals are

…just a license to steal!

…just a license to steal!

Conflation of issues:

Poor Credit regulation/Congress actively encouraging sub-prime mortgages.

Wall Street firms package sub-primes as a new "agressive growth" investment.

Mortgage value bubble starts to deflate, undercutting the "growth" expected.

Oil Price "push" hammers industry spending and encourages USA (and others) to pull back on private discretionary spending.

Foreclosure rates accelerate, Mortgage debt/credit crisis intensify.

Government "bailout" efforts not only include the 750bn bailout (+100b in pork) on top of the bailouts for Bear-Stearns and AIG (c. 300b), but also include the 3 Trillion in bonds floated over the last 8 weeks (The goal has been to flood the system with money and prevent runs on banks from ever occurring. Bank failures have not even come close to the failure percentages of the 1930s -- though the conditions for bank failure haven't been as ripe at any other times since).

This is the first time in a long time we've experienced reduction in bond value/yield at the same time as stocks have taken such a hit. There's been something of a rally in the last week from "Santa" and we can expect a bit more since Black Friday was 7% up over last year's, but it's a long way back to the highs of October 2007.

Gold is improving, but not by leaps and bounds.

Deflation is a distince possibility, and only moderate period of significant inflation can prevent it.

Sucks all around.

Poor Credit regulation/Congress actively encouraging sub-prime mortgages.

Wall Street firms package sub-primes as a new "agressive growth" investment.

Mortgage value bubble starts to deflate, undercutting the "growth" expected.

Oil Price "push" hammers industry spending and encourages USA (and others) to pull back on private discretionary spending.

Foreclosure rates accelerate, Mortgage debt/credit crisis intensify.

Government "bailout" efforts not only include the 750bn bailout (+100b in pork) on top of the bailouts for Bear-Stearns and AIG (c. 300b), but also include the 3 Trillion in bonds floated over the last 8 weeks (The goal has been to flood the system with money and prevent runs on banks from ever occurring. Bank failures have not even come close to the failure percentages of the 1930s -- though the conditions for bank failure haven't been as ripe at any other times since).

This is the first time in a long time we've experienced reduction in bond value/yield at the same time as stocks have taken such a hit. There's been something of a rally in the last week from "Santa" and we can expect a bit more since Black Friday was 7% up over last year's, but it's a long way back to the highs of October 2007.

Gold is improving, but not by leaps and bounds.

Deflation is a distince possibility, and only moderate period of significant inflation can prevent it.

Sucks all around.

It would have been better spent on capital works.

The next Hoover Dam, a bigger NASA, more blankets and fresh water in the 3rd world... all of them aimed at generating a demand for infrastructure, knowledge and goodwill and all of them providing jobs... stimulate the economy by giving people money directly is welfare. What has happened is the biggest corporate welfare project in history, and they are still taking home bonuses!

The next Hoover Dam, a bigger NASA, more blankets and fresh water in the 3rd world... all of them aimed at generating a demand for infrastructure, knowledge and goodwill and all of them providing jobs... stimulate the economy by giving people money directly is welfare. What has happened is the biggest corporate welfare project in history, and they are still taking home bonuses!

Bigger NASA? Hell yea! Do you hear of these problems on Mars? Didn’t think so.

But no, seriously, get me the out of here.

out of here.

But no, seriously, get me the

out of here.

out of here.Despite the best Thanksgiving weekend spending in several years, the market dropped again today. Its that kind of cycle.

Since we've officially been in a recession since December 2007 (?!? I guess someone forgot to send out the memo back in January) people no longer need to speak the 'R' word in hushed tones. I wonder how much longer we can hold off the inevitability of the coming of the 'H' word?

Here it comes...

http://en.wikipedia.org/wiki/Hyperinflation

Here it comes...

http://en.wikipedia.org/wiki/Hyperinflation

I forgot to comment on the lovely pie charts. Nice find Lemur. Thank you for the pie. Who doesn't like pies? I prefer pecan...

I noticed they omitted our expenditures for WW2 which, even by today's standards, were gob smackingly massive. One thing for sure is we used to get a helluva lot more for our money.

Seriously now, is it even reasonable to think this is all going to work out for the best?

Just when you thought it was safe to feel optimistic... Here is a massive 'economic stimulus' bill from the glorious mind of Nancy Pelosi. This time in the tune of $500 BILLION dollars. And this bill isn't linked to any bank or car company bail-out. Of course that bill is bound to incur upwards of an additional $100 billion in earmark spending... I just love watching these post-war generation ninnies pi$$ our money away...

Mark my words, Obama's going to get alot of use out of that rubberstamp...

http://news.yahoo.com/s/nm/20081201/...onomy_stimulus

I noticed they omitted our expenditures for WW2 which, even by today's standards, were gob smackingly massive. One thing for sure is we used to get a helluva lot more for our money.

Seriously now, is it even reasonable to think this is all going to work out for the best?

Just when you thought it was safe to feel optimistic... Here is a massive 'economic stimulus' bill from the glorious mind of Nancy Pelosi. This time in the tune of $500 BILLION dollars. And this bill isn't linked to any bank or car company bail-out. Of course that bill is bound to incur upwards of an additional $100 billion in earmark spending... I just love watching these post-war generation ninnies pi$$ our money away...

Mark my words, Obama's going to get alot of use out of that rubberstamp...

http://news.yahoo.com/s/nm/20081201/...onomy_stimulus

Didn't the living standards for Americans increase during WWII? Or is that an Urban Myth?

Originally Posted by Papewaio:

Didn't the living standards for Americans increase during WWII? Or is that an Urban Myth?

I really doubt that was true. There was a lot of rationing of stuff like meat and oil to supply the war effort. However, living standards did rise dramatically after the war.Didn't the living standards for Americans increase during WWII? Or is that an Urban Myth?

edit: btw, how much is kiwiland being affected by all this?

Originally Posted by woad&fangs:

I really doubt that was true. There was a lot of rationing of stuff like meat and oil to supply the war effort. However, living standards did rise dramatically after the war.

edit: btw, how much is kiwiland being affected by all this?

The standard of living had dropped dramatically during the worst period of recession just before the war ('37-38), when we had more than 18% unemployment. I really doubt that was true. There was a lot of rationing of stuff like meat and oil to supply the war effort. However, living standards did rise dramatically after the war.

edit: btw, how much is kiwiland being affected by all this?

During the war, there was rationing, but virtually full employment with loads of people in the workforce who hadn't been before. We actually had more money in the economy, but between rationinng, bonds, and war taxes it didn't really get felt.

Shortly after the war, a series of tax-cuts, plentiful labor, fewer competitors etc. allowed the standard of living to sky-rocket.

Since then, as Europe isn't a wasteland, the communist block has fallen and many more countries are competing for work it is unlikely that the American standard of living wil be maintained for all.

The world's standard of living on average will increase, but this will probably be felt by those in India and China rising rather than in the USA.

As the Detroit 3 are illustrating, the downward pressure on salaries and benefits is partly due to other countries offering the same, if not better, products for less.

Americans expect their standards of living to drift up without effort, as it has done for the last 50 years. Debt has helped pay for this so far, it might not do so as easily int he future.

The world's standard of living on average will increase, but this will probably be felt by those in India and China rising rather than in the USA.

As the Detroit 3 are illustrating, the downward pressure on salaries and benefits is partly due to other countries offering the same, if not better, products for less.

Americans expect their standards of living to drift up without effort, as it has done for the last 50 years. Debt has helped pay for this so far, it might not do so as easily int he future.

Originally Posted by Spino:

Since we've officially been in a recession since December 2007 (?!? I guess someone forgot to send out the memo back in January) people no longer need to speak the 'R' word in hushed tones. I wonder how much longer we can hold off the inevitability of the coming of the 'H' word?

Here it comes...

It's interesting to me that the pronouncement actually hurts the market. I mean, if they can't tell if we're in one or not...Since we've officially been in a recession since December 2007 (?!? I guess someone forgot to send out the memo back in January) people no longer need to speak the 'R' word in hushed tones. I wonder how much longer we can hold off the inevitability of the coming of the 'H' word?

Here it comes...

Funny that Congress demands a detailed business plan, cuts in executive pay & perks, labor concessions etc. from the automakers, but threw billions at Insurance & Banking firms with no such restrictions or strings attached. And of course the entitled masters of the financial world continued on their merry way, entitlements intact, and coal in everyone else's stocking. Is it really surprising some segments of society didn't realize a recession has been going on since 2007?

Congress is a collection of cagey polls with VERY incisive minds for the politics of the situation.

When it comes to knowing anything about economics, Congres has VERY incisive minds for the politics of the situation.

When it comes to knowing anything about economics, Congres has VERY incisive minds for the politics of the situation.

Originally Posted by woad&fangs:

I really doubt that was true. There was a lot of rationing of stuff like meat and oil to supply the war effort. However, living standards did rise dramatically after the war.

edit: btw, how much is kiwiland being affected by all this?

Considering he is from Sydney like me(not kiwiland/ New Zealand); i thought i would chip in. Australia is limited in its major exposure due to tight regulations on the banking and investment sectors. As such despite some bad overseas investments most of our banks are still well afloat. There has been a dramatic slow down in the economy. There is a certain amount of flex in our economy due to our massive resources supplies. Public works in other countries will likely help Australia by maintaining demand for coal/iron and other raw minerals. I really doubt that was true. There was a lot of rationing of stuff like meat and oil to supply the war effort. However, living standards did rise dramatically after the war.

edit: btw, how much is kiwiland being affected by all this?

I think the Australian Government has guaranteed all bank deposits for a set timetable as well as the Reserve bank has had some room to drop interest rates (from 8.0% or so) down to around 4.5% at the moment. up until mid this year interest rates were climbing to fight off inflation. I think a major reason why Australia can deal with such problems easier then other countries is a good balance between responsible interest rate management and balanced tax/spending enabling for being able to respond when needed without making huge dept or other such long term problems.

I can't help but to think all these problems are linked. More economic cars would enable people to spend more money on other things, it would make the cars more popular in other countries, it would make them cheaper to make. less public money would be needed to buy out expensive car operations. Better control of banking systems and spending would enable a more resilient economy. These are just examples but i think it helps to start joing dots when trying to understand something as massive as a global economic meltdown.

id like to hear others take on it.

Originally Posted by Beren Son Of Barahi:

I think the Australian Government has guaranteed all bank deposits for a set timetable as well as the Reserve bank has had some room to drop interest rates (from 8.0% or so) down to around 4.5% at the moment. up until mid this year interest rates were climbing to fight off inflation. I think a major reason why Australia can deal with such problems easier then other countries is a good balance between responsible interest rate management and balanced tax/spending enabling for being able to respond when needed without making huge dept or other such long term problems.

Our big problem though is that we have almost no Infrastructure to help us take advantage of this - the previous government spent all the extra money on tax cuts. If China goes under (Which is quite likely) then there is no way for us to stay out of a recession. The public works projects in other countries is a good point that might indeed help us, but the big problem with that is that Europe can provide most of its own resources and America is unlikely to import to many resources from us. So again we fall back on our over-reliance on China.I think the Australian Government has guaranteed all bank deposits for a set timetable as well as the Reserve bank has had some room to drop interest rates (from 8.0% or so) down to around 4.5% at the moment. up until mid this year interest rates were climbing to fight off inflation. I think a major reason why Australia can deal with such problems easier then other countries is a good balance between responsible interest rate management and balanced tax/spending enabling for being able to respond when needed without making huge dept or other such long term problems.

It would be interesting to compare the total scale of the banking bailout and other banking losses with the total dividends paid by the banks since, I don't know, how far back should we go? 30 years seems fair, that's a generation, and gets us back to the last big one.

Is it just me or do banks actually not make any money? It seems to me all they do is shift money from governments to shareholders, and timeshift the payments. When things are fairly stable, they make small (in percentage terms) profits running big risks that don't actually materialise, and tell themselves they are the New Gods of the economy. Then the risks materialise (risks paid for, if you like, with those profits made in the easy years, all of which have of course been paid out long ago), and they get bailed out. The profit was in effect a pre-emptive distribution of the bailout, but because it is shifted in time they get away with it. If I went to the government and said I wanted a big slug of taxpayers cash to pay to my shareholders right now I would never get it, why does it make any difference if I make the payout first, and then take my feckless backside off begging to the Treasury?

What I suspect is that banking just isn't an industry like car making, and, if market disciplines cannot apply (because a big bank cannot be allowed to fail) then nor should market incentives (fat bonuses and dividends). As a rule a fat return should be a price for a high risk and as we have all just had deomnstrated actually running a bank is a low risk activity.

Is it just me or do banks actually not make any money? It seems to me all they do is shift money from governments to shareholders, and timeshift the payments. When things are fairly stable, they make small (in percentage terms) profits running big risks that don't actually materialise, and tell themselves they are the New Gods of the economy. Then the risks materialise (risks paid for, if you like, with those profits made in the easy years, all of which have of course been paid out long ago), and they get bailed out. The profit was in effect a pre-emptive distribution of the bailout, but because it is shifted in time they get away with it. If I went to the government and said I wanted a big slug of taxpayers cash to pay to my shareholders right now I would never get it, why does it make any difference if I make the payout first, and then take my feckless backside off begging to the Treasury?

What I suspect is that banking just isn't an industry like car making, and, if market disciplines cannot apply (because a big bank cannot be allowed to fail) then nor should market incentives (fat bonuses and dividends). As a rule a fat return should be a price for a high risk and as we have all just had deomnstrated actually running a bank is a low risk activity.

As a rule a fat return should be a price for a high risk and as we have all just had deomnstrated actually running a bank is a low risk activity.

I have been wondering about this, the whole excuse for high profits is the high risk they take.... without the risk... hell i would rather the goverment took this non existant risk stockpiled the profits and then used them when the crap hits the fan, that way we can still keep the banking industry going without having to spend taxpayers money on it when it goes wrong...

Nationalisation FTW!

I have been wondering about this, the whole excuse for high profits is the high risk they take.... without the risk... hell i would rather the goverment took this non existant risk stockpiled the profits and then used them when the crap hits the fan, that way we can still keep the banking industry going without having to spend taxpayers money on it when it goes wrong...

Nationalisation FTW!

Originally Posted by Papewaio:

It would have been better spent on capital works.

The next Hoover Dam, a bigger NASA, more blankets and fresh water in the 3rd world... all of them aimed at generating a demand for infrastructure, knowledge and goodwill and all of them providing jobs... stimulate the economy by giving people money directly is welfare. What has happened is the biggest corporate welfare project in history, and they are still taking home bonuses!

I couldn't agree more. It would have been better spent on capital works.

The next Hoover Dam, a bigger NASA, more blankets and fresh water in the 3rd world... all of them aimed at generating a demand for infrastructure, knowledge and goodwill and all of them providing jobs... stimulate the economy by giving people money directly is welfare. What has happened is the biggest corporate welfare project in history, and they are still taking home bonuses!

Originally Posted by English assassin:

What I suspect is that banking just isn't an industry like car making, and, if market disciplines cannot apply (because a big bank cannot be allowed to fail) then nor should market incentives (fat bonuses and dividends). As a rule a fat return should be a price for a high risk and as we have all just had deomnstrated actually running a bank is a low risk activity.

Agreed. I generally prefer a hands-off policy in economics, but if it can't be consistently applied by letting busineses go bankrupt when they What I suspect is that banking just isn't an industry like car making, and, if market disciplines cannot apply (because a big bank cannot be allowed to fail) then nor should market incentives (fat bonuses and dividends). As a rule a fat return should be a price for a high risk and as we have all just had deomnstrated actually running a bank is a low risk activity.

up, then

up, then  them. I'll take a regulated, stable market over the sort of corporate buffet that the USA seems to become.

them. I'll take a regulated, stable market over the sort of corporate buffet that the USA seems to become.Single Sign On provided by vBSSO