First a report shows that the five biggest banks in the U.S.A. are dead men walking.

America's five largest banks, which already have received $145 billion in taxpayer bailout dollars, still face potentially catastrophic losses from exotic investments if economic conditions substantially worsen, their latest financial reports show.

Citibank, Bank of America, HSBC Bank USA, Wells Fargo Bank and J.P. Morgan Chase reported that their "current" net loss risks from derivatives — insurance-like bets tied to a loan or other underlying asset — surged to $587 billion as of Dec. 31. Buried in end-of-the-year regulatory reports that McClatchy has reviewed, the figures reflect a jump of 49 percent in just 90 days. [...]

Federal regulators portray the potential loss figures as worst-case. However, the risks of these off-balance sheet investments, once thought minimal, have risen sharply as the U.S. has fallen into the steepest economic downturn since World War II, and the big banks' share prices have plummeted to unimaginable lows.

The I read that AIG issued a confidential report that it could fall quite easily, and take down the entire financial system with it:

A draft of the report, obtained by ABC News, was marked "strictly confidential." It said, "The failure of AIG would cause turmoil in the U.S. economy and global markets and have multiple and potentially catastrophic unforeseen consequences." [...] AIG warns in its report of the "systemic risk" that a potential collapse posed. It describes a "systemic risk" as one that "could potentially bankrupt or bring down the entire system or market."

The company said, "What happens to AIG has the potential to trigger a cascading set of further failures, which cannot be stopped except by extraordinary means."

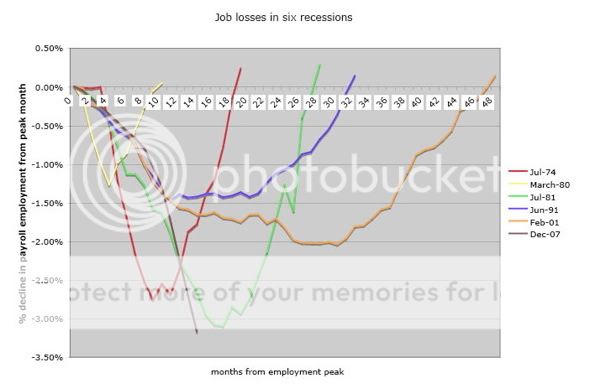

And then I look at the latest unemployment chart, comparing this recession's job losses with previous ones:

None of my neighbors are going through my garbage for food, and I haven't seen any shantytowns. But when do we call this a depression?

Reply With Quote

Reply With Quote

Bookmarks