When we cut health care for the poor but leave in the Bush tax cuts?

Or is that simply "HAHA I HAVE CONGRESS NOW, TIME TO PAYBACK THE FAVORS"

When we cut health care for the poor but leave in the Bush tax cuts?

Or is that simply "HAHA I HAVE CONGRESS NOW, TIME TO PAYBACK THE FAVORS"

There, but for the grace of God, goes John Bradford

My aim, then, was to whip the rebels, to humble their pride, to follow them to their inmost recesses, and make them fear and dread us. Fear is the beginning of wisdom.

I am tired and sick of war. Its glory is all moonshine. It is only those who have neither fired a shot nor heard the shrieks and groans of the wounded who cry aloud for blood, for vengeance, for desolation.

It really makes me frustrated how people don't understand this.

You are aware that the Bush tax cuts shifted even more of the tax burden away from the poor and onto the wealthy and actually created direct subsidies for the poorest Americans, correct? That means that the Bush tax cuts actually created a new source of revenue, in the form of a check from the IRS, for the poorest Americans that didn't exist before. In effect, millions of poor Americans not only pay no tax, but get paid by the government.

It amazes me how misunderstood that and mischaracterized the tax cuts have been. President Bush wanted them to help everyone, but it is kind of difficult to give a tax break to people who pay no taxes, so they actually went to the extraordinary length of subsidizing the poor. It was the most progressive (sympathetic to the poor) tax policy in American history and still got labeled "tax cuts for the rich". Rhetoric over reality, as usual.

Last edited by PanzerJaeger; 04-15-2011 at 02:49.

There, but for the grace of God, goes John Bradford

My aim, then, was to whip the rebels, to humble their pride, to follow them to their inmost recesses, and make them fear and dread us. Fear is the beginning of wisdom.

I am tired and sick of war. Its glory is all moonshine. It is only those who have neither fired a shot nor heard the shrieks and groans of the wounded who cry aloud for blood, for vengeance, for desolation.

PJ, I don't understand. Bush cut the top bracket from 39.5% to 35% if IIRC. He also cut the dividend/long term gain tax to 10% from it's top rate of 39.5%. He drastically increased the estate tax exemption, and dropped the top rate of the gift tax to 35%. When you are pulling in a lot of money, these rate changes cut your overall tax burden substantially.

Now for the lower income earners, he eliminated the div/long term cap gains tax. That's great except most low income earners don't recieve stock dividends nor long term capital gains. When I worked in public accounting, I don't think I ever saw anyone taxed at this rate. The cuts did do some good and created the 10% tax bracket for the lowest earners, but honestly in relative terms, the top earners saw a substantial (hundreds of thousands and even millions) of dollars in tax savings.

As for strike's point, didn't Obama's budget contain a reversal of them for over 250k earners? It passed the house today which will mean it will become official.

Last edited by Ice; 04-15-2011 at 03:23.

There's a strong case to be made that we should wait for austerity until the economy gets back on track.Just as bad my friend, we need austerity measures

Last edited by Lord Winter; 04-15-2011 at 03:18.

When it occurs to a man that nature does not regard him as important and that she feels she would not maim the universe by disposing of him, he at first wishes to throw bricks at the temple, and he hates deeply the fact that there are no bricks and no temples

-Stephen Crane

Well, as I said, it is very difficult to realize substantial tax reductions for the quintiles that already pay very little or nothing in taxes. However, they engineered the policy in a way that despite the fact that the rich realized larger monetary savings, they also took on an even larger share of the overall burden - and the very poor were given subsidies to make up for the fact that a 5, 10 or 95% tax cut had no impact on them.

Popular mythology also suggests that the 2001 and 2003 tax cuts shifted more of the tax burden toward the poor. While high-income households did save more in actual dollars than low-income households, they did so because low-income households pay so little in income taxes in the first place. The same 1 percent tax cut will save more dollars for a millionaire than it will for a middle-class worker simply because the millionaire paid more taxes before the tax cut.

In 2000, the top 60 percent of taxpayers paid 100 percent of all income taxes. The bottom 40 percent collectively paid no income taxes. Lawmakers writing the 2001 tax cuts faced quite a challenge in giving the bulk of the income tax savings to a population that was already paying no income taxes.

Rather than exclude these Americans, lawmakers used the tax code to subsidize them. (Some economists would say this made that group's collective tax burden negative.)First, lawmakers lowered the initial tax brackets from 15 percent to 10 percent and then expanded the refundable child tax credit, which, along with the refundable earned income tax credit (EITC), reduced the typical low-income tax burden to well below zero. As a result, the U.S. Treasury now mails tax "refunds" to a large proportion of these Americans that exceed the amounts of tax that they actually paid. All in all, the number of tax filers with zero or negative income tax liability rose from 30 million to 40 million, or about 30 percent of all tax filers.[17] The remaining 70 percent of tax filers received lower income tax rates, lower investment taxes, and lower estate taxes from the 2001 legislation.

Consequently, from 2000 to 2004, the share of all individual income taxes paid by the bottom 40 percent dropped from zero percent to –4 percent, meaning that the average family in those quintiles received a subsidy from the IRS. (See Chart 6.) By contrast, the share paid by the top quintile of households (by income) increased from 81 percent to 85 percent.

Expanding the data to include all federal taxes, the share paid by the top quintile edged up from 66.6 percent in 2000 to 67.1 percent in 2004, while the bottom 40 percent's share dipped from 5.9 percent to 5.4 percent. Clearly, the tax cuts have led to the rich shouldering more of the income tax burden and the poor shouldering less.[18]

How does that make sense...you are paying less but you are paying more at the same time...(I know, I know, there are less overall taxes being collected...but I wonder if that has less to do with the tax cuts and more to do with the fact that nobody can find a job...and you can't tax what you can't earn).

From what I can see, it is the middle class that got screwed once again. I noticed some interesting divisions in the statistics in the page you referenced.

The rich got the great tax savings, the poor got the subsidies, but the middle class - not rich enough to get the tax savings and not poor enough to get the subsidies, they get the shaft.

Even though the report shows that the top quintile moves up very slightly in it's portion of the tax burden, they make the division there (top 20%) so as to be able to make that point. If you changed it to the top 10%, or worse, the top 1% then you would see a reduction in their share of the tax burden.

Toda Nebuchadnezzar : Trust Jaguara to come up with the comedy line

"The only thing I am intolerant of is intolerance"

Who did what now?

It's because more people with low incomes are now paying nothing. The fact is, we can't tax our way out of this. Spending is out of control and has to be reined in. Sadly, it's real easy to politicians to create entitlement programs, but much harder to cut or even reform them.Originally Posted by Jaguara

Medicare and Social Security just aren't sustainable as they exist currently.

"Don't believe everything you read online."

-Abraham Lincoln

Why are people pulling "facts" from Heritage and Reason.tv? Seriously, no offense but if you want my attention, source something that doesn't blatantly proclaim "We are libertarian and/or conservative and will give facts supporting this view!"

I am just very picky when it comes to news sources. If all the info comes from the CBO, I would like to read the official CBO report, not a summary from Heritage. The article could be great, I just have very high standards of where I get sources of info. I am not particularly great at English and am not good at recognizing spin in writing so I try to minimize my exposure to it. You won't see me lurking the Huff Po either just to clarify.

Sigh... I just spent half an hour doing analysis comparing 2001 to 2003 numbers for a variety of taxpayers but my browser crashed and nothing saved. Thus I will keep this brief because I don't feel like retyping everything.

I don't quite understand why you posted this link as I never implied that poor people were paying more of a tax burden after the cuts. I basically said the rich benefited greatly while most people got the less attractive end of the stick.Popular mythology also suggests that the 2001 and 2003 tax cuts shifted more of the tax burden toward the poor. While high-income households did save more in actual dollars than low-income households, they did so because low-income households pay so little in income taxes in the first place. The same 1 percent tax cut will save more dollars for a millionaire than it will for a middle-class worker simply because the millionaire paid more taxes before the tax cut.

You are correct that the poor do not much in taxes... I guess I should have used the words "extra money" instead of tax savings. You are also correct that lower earners received more in subsidies.

First, the subsides you speak of were only helpful if you had a child. The child tax credit was increased $500 per child and the EI credit increased a few thousand or two at its maximum amount which you pretty much would have to live under a bridge to qualify for. The extreme poor saw a 2,000 to 3,000 in extra money IF they had children AND were married. Without kids they do not qualify for any of the credits. The rich, and I mean rich (I used anywhere from 500,000 to 5 million in my analysis) saw thousands upon thousands of dollars in extra money. The middle class basically got screwed and received a few thousand in tax savings.

Sorry PJ, giving high income earners anywhere from $50,000 to $200,000 (Based off $500,000 and $5,000,000 in income) in extra money while giving middle and lower class earners only a few thousand more is simply ludicrous. I really don't care if lower earners pay a negative tax because they are poor and need the money. Can you imagine try to feed a family of 4 on 12,000 to 20,000 per year in most areas? It really is common sense to expand the funds these people receive to ensure they have a basic standard of living. There is absolutely no need to give people who are already very well off and have everything they need, such a large chunk of extra money simply because they pay the most in taxes. There is a reason they pay the most in taxes... its because they can easily afford it. Poor people can't and need every cent we give them to survive.

If Bush really wanted to "help everyone out", he would have cut the top tax rates by a 1% and doubled the subsidy increases he gave for the lower earners.

I thought that you didn't understand the way in which I was explaining it.

There is a lot of ideology in this. One could also point out that the poor, who use by far the most public services, pay absolutely nothing for them. Should 'we' be paying them for the privilege through direct subsidies in the tax system? Would it really be a smart precedent to set to give the poor not a few thousand but tens of thousands of dollars simply for existing? I suspect we have differing views on that subject, as I don't even agree with the current subsidies.Sorry PJ, giving high income earners anywhere from $50,000 to $200,000 (Based off $500,000 and $5,000,000 in income) in extra money while giving middle and lower class earners only a few thousand more is simply ludicrous. I really don't care if lower earners pay a negative tax because they are poor and need the money. Can you imagine try to feed a family of 4 on 12,000 to 20,000 per year in most areas? It really is common sense to expand the funds these people receive to ensure they have a basic standard of living. There is absolutely no need to give people who are already very well off and have everything they need, such a large chunk of extra money simply because they pay the most in taxes. There is a reason they pay the most in taxes... its because they can easily afford it. Poor people can't and need every cent we give them to survive.

If Bush really wanted to "help everyone out", he would have cut the top tax rates by a 1% and doubled the subsidy increases he gave for the lower earners.

In any event, it is obvious that those who pay taxes are going to be more sensitive to changes in tax policy than those who pay no taxes, and it is nearly impossible to make said changes in an equitable manner. Nevertheless, the Bush tax cuts were more favorable to the poor than the Clinton tax system both on a macro level, by moving more of the total burden away from the poor, and on an individual level, through the direct subsidies and the reclassification of millions of people 'on the edge' down to a quintile that pays no taxes.

I have never seen a poor person manage to walk out of Target without paying the 9.25% (maybe it's even higher) sales tax.

Hmm I'm reminded of this lineOne could also point out that the poor, who use by far the most public services, pay absolutely nothing for them. Should 'we' be paying them for the privilege through direct subsidies in the tax system?

And I say to my people's masters: Beware,

Beware of the thing that is coming, beware of the risen people,

Who shall take what ye would not give.

In other words tis better to accept a smaller slice else the people in there anger take the whole loaf.

They slew him with poison afaid to meet him with the steel

a gallant son of eireann was Owen Roe o'Neill.

Internet is a bad place for info Gaelic Cowboy

Have you ever seen a poor person buy food at Target? Have you ever seen a poor person buy anything in Alaska, Oregon, Montana, Deleware, or New Hampshire?

Anyway, I thought we were talking about federal taxes. The Bush tax cuts had nothing to do with state and local taxes.

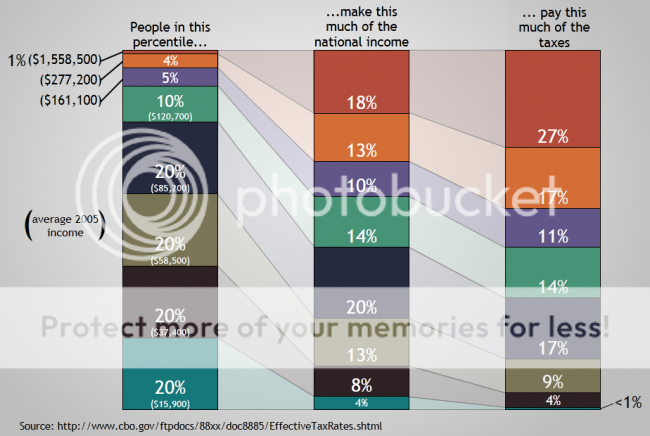

Here's how the current tax scheme play's out. (Actually, the higher brackets are paying an even greater percentage of the taxes today than in 2005.)

I don't support buying off the unwashed out of fear of violent revolution.

Last edited by PanzerJaeger; 04-21-2011 at 02:16.

You made an over generalization. Don't even try to cover it up. You said this: One could also point out that the poor, who use by far the most public services, pay absolutely nothing for them. You said nothing about federal public services, you just said public services. I thought were were talking about the Federal government?

All I said was that the poor don't get out of paying sales tax. Lol, I guess the poor don't shop at the upper middle class stores like "Target" and "Smart and Final", let me rephrase it. I have never seen a poor person manage to walk out of the door of Walmart without paying the 9.25% sales tax. Tax which goes to public services which the state and local governments provide.

Maybe you should be more careful about what you say before you try to criticize someone else for the same thing.

All that chart shows is that the rich are not paying enough. Lol, all you did was look at the last two bars and saw that for the top 1% that paying 27% of the total dollars gained in taxes is more than the 18% of the total national income that they constitute thus we are socialist and taxes are too high. This of course, doesn't mean anything without taking into account the relative discrepancy of the average salaries between the different quartiles.Here's how the current tax scheme play's out. (Actually, the higher brackets are paying an even greater percentage of the taxes today than in 2005.)

The fact is that the top 1% are making at least 18.9 times more money in terms of dollars than the middle 60% on average. However, the top 1% pay 27% of the total taxes while the middle 60% pay 30% of the total taxes. The middle class are paying more in tax in a total dollar amount even though the top 1% are making over a magnitude of order more than them on average.

Oh blah, blah the poor still making off like bandits. Yeah, well the rich are as well, leaving the burden on the middle class. Wonder why it is disappearing.

...in a discussion about the Bush era federal tax cuts. Why in the world would such a discussion have anything to do with state sales taxes? Why would that need to be spelled out?

You made an incorrect assumption. Don't even try and cover it up.

You are aware that state sales taxes a) have nothing to do with federal taxes and b) vary by state, correct?All I said was that the poor don't get out of paying sales tax. Lol, I guess the poor don't shop at the upper middle class stores like "Target" and "Smart and Final", let me rephrase it. I have never seen a poor person manage to walk out of the door of Walmart without paying the 9.25% sales tax. Tax which goes to public services which the state and local governments provide.

Of course they do. There are also far, far more middle class people than there are rich people, yet they pay only 3% more of the total tax receipts.All that chart shows is that the rich are not paying enough. Lol, all you did was look at the last two bars and saw that for the top 1% that paying 27% of the total dollars gained in taxes is more than the 18% of the total national income that they constitute thus we are socialist and taxes are too high. This of course, doesn't mean anything without taking into account the relative discrepancy of the average salaries between the different quartiles.

The fact is that the top 1% are making at least 18.9 times more money in terms of dollars than the middle 60% on average. However, the top 1% pay 27% of the total taxes while the middle 60% pay 30% of the total taxes. The middle class are paying more in tax in a total dollar amount even though the top 1% are making over a magnitude of order more than them on average.

You're making more assumptions. I never said the poor are making off like bandits. I simply disagree with the talking point that the Bush tax cuts were exclusively for the rich. Great efforts were made (overreach in my opinion) to ensure that everyone benefited from them, even those that pay no taxes.Oh blah, blah the poor still making off like bandits. Yeah, well the rich are as well, leaving the burden on the middle class. Wonder why it is disappearing.

Last edited by PanzerJaeger; 04-21-2011 at 04:25.

Except that isn't the context in which you put it in. You said it partly comes down to ideology. That you could say that poor don't pay into any social programs. When you link that to an ideology, it gives the impression that you making an overarching ideological assumption and are applying it. Yeah, you can back track and say "well of course I was talking specifically about federal government." but it is easy to talk about what you meant when it wasn't specific in the first place. I don't know any ideology (and lets be honest, it's the conservative ideology that looks down on poor like that), that says that the poor are freeriders who don't pay anything for federal government programs. Oddly specific for a broad ideology.

But whatever, this isn't what the topic is about at all. If you want to make vague statements and then claim afterward that it all applied to the main topic of the thread, go ahead.

Again, you are trying to back track and say that your sentence was about something specific when you know by now that I had interpreted it as a broad generalization. So this whole attempt at making me lose "face" by portraying me as "off topic" fails miserably. Also, your b makes no sense. Only 3 states have no sales tax at all. Alaska, Delaware and Montana, hardly where most of the poor are. Vast majority of poor still pay some amount of sales tax, thus they pay into state services, thus your b is invalid.You are aware that state sales taxes a) have nothing to do with federal taxes and b) vary by state, correct?

Exactly. And of course anyone who has taken basic econ courses know that the standard of living for someone living on $50,000 is much more impacted by having to contribute 30% of the taxes than it is for someone living on $1.5 million who has to contribute 27% of the total taxes.Of course they do. There are also far, far more middle class people than there are rich people, yet they pay only 3% more of the total tax receipts.

The idea that the system is "fair" when all parties are paying the same dollar amount is flawed. The value of the dollar is not standard for all "players"(the taxpayers) in the system.

Let's say there are two people. One has $5, one has $500 dollars. The amount needed to be payed for the "bill" is $4. It is not fair for each to have to pay $2 into the system because while the rich man has 99.6% of his money left the poor man has 60% of his money left. It doesn't matter if there was 1 rich man and 100 poor people. If they split it evenly the poor (relative to the rich person) is going to take a bigger hit if they all have to pay the same dollar amount towards the bill as the 1 rich person.

This apples to the graph you posted. The middle class should be paying 3% more of the bill than the rich, the rich should be paying 10% more than all the middle class because the burden that the rich will take from paying a lot more will be equal to the burden of the middle class, because even though the middle class pays less they make substantially less money to begin with.

The relative of burden was largely in the rich's favor. As Ice said, the tax cuts ended up cutting hundreds of thousand for the rich, a couple thousand for the poor and middle class. Taxes on capital gains went down a lot for all incomes levels, but the vast majority of capital gains to be taxed on are held by the rich, so that by itself gave the rich much, much more money than the poor or middle class could ever hope to receive.You're making more assumptions. I never said the poor are making off like bandits. I simply disagree with the talking point that the Bush tax cuts were exclusively for the rich. Great efforts were made (overreach in my opinion) to ensure that everyone benefited from them, even those that pay no taxes.

Last edited by a completely inoffensive name; 04-21-2011 at 07:39.

Here is the whole statement:

You'll note that not only was the quote I was responding to about the subsidies in the Bush tax cuts, but last three sentences in my reply refer directly to the subsidies in the Bush tax cuts, which had been the subject of the discussion between Ice and myself. So if you had any doubt about the first two sentences, the last three - being in the same paragraph - should have cleared up your confusion.Originally Posted by pj

Just face it, you either skimmed my post or just read Jbarto's and incorrectly believed I had been caught in an 'ah ha!' moment and decided to pile on. I really don't mind. I have enough real 'ah ha!' moments that you would be forgiven for believing you'd caught me in another.

I'm not attempting to make you lose face. It was simply a misunderstanding.Again, you are trying to back track and say that your sentence was about something specific when you know by now that I had interpreted it as a broad generalization. So this whole attempt at making me lose "face" by portraying me as "off topic" fails miserably. Also, your b makes no sense. Only 3 states have no sales tax at all. Alaska, Delaware and Montana, hardly where most of the poor are. Vast majority of poor still pay some amount of sales tax, thus they pay into state services, thus your b is invalid.

My 'b)' statement:

I'm not sure how the statement could be valid/invalid.Originally Posted by pj

State sales tax does in fact vary and I was simply asking if you know that. You keep repeating the 9.25% number as if it is the number instead of a number, but instead of assuming () that is what you meant, I asked.

Also, iirc, Oregon and New Hampshire have no sales tax.

I think you're logic is a bit off as far, far more people contribute to that 30% pool than to the 27% one.Exactly. And of course anyone who has taken basic econ courses know that the standard of living for someone living on $50,000 is much more impacted by having to contribute 30% of the taxes than it is for someone living on $1.5 million who has to contribute 27% of the total taxes.

For example, if you have 500 people who earn $10 a year who have to pay 30% of a $1000 tax burden and 5 people who make $100 who have to pay 27%, members of the 500 pay .60 cents each and the 5 people have to pay $54 each.

Math is not at all a personal strength, so that little equation could be the 'ah ha!' moment you've been looking for.

I haven't taken the position that the rich should pay less taxes, only that the Bush tax cuts were not exclusively for the rich and were, in fact, favorable to the poor.The idea that the system is "fair" when all parties are paying the same dollar amount is flawed. The value of the dollar is not standard for all "players"(the taxpayers) in the system.

Let's say there are two people. One has $5, one has $500 dollars. The amount needed to be payed for the "bill" is $4. It is not fair for each to have to pay $2 into the system because while the rich man has 99.6% of his money left the poor man has 60% of his money left. It doesn't matter if there was 1 rich man and 100 poor people. If they split it evenly the poor (relative to the rich person) is going to take a bigger hit if they all have to pay the same dollar amount towards the bill as the 1 rich person.

This apples to the graph you posted. The middle class should be paying 3% more of the bill than the rich, the rich should be paying 10% more than all the middle class because the burden that the rich will take from paying a lot more will be equal to the burden of the middle class, because even though the middle class pays less they make substantially less money to begin with.

Obviously those who pay more taxes are more sensitive to changes in the tax code either way. Strike's initial post seemed to imply that the GOP was proposing hurting the poor in favor of helping the rich. My whole involvement in this thread has been to argue that 'leaving the Bush tax cuts', as he put it, in fact helps the poor. And if we are going to use the marginal value of a dollar argument that the progressive tax system is based on, removing the Bush tax cuts will hurt the poor far more than the rich.The relative of burden was largely in the rich's favor. As Ice said, the tax cuts ended up cutting hundreds of thousand for the rich, a couple thousand for the poor and middle class. Taxes on capital gains went down a lot for all incomes levels, but the vast majority of capital gains to be taxed on are held by the rich, so that by itself gave the rich much, much more money than the poor or middle class could ever hope to receive.

Last edited by PanzerJaeger; 04-21-2011 at 09:39.

Ahh shoot. I do apologize, I had read your post but then after reading Jbarto's I had gotten the wrong impression of what you had said.

I had assumed that you were bringing up the fact about varying sales taxes to make a point that the poor are able to get out of paying for services on the state level. My statement was to bring up the fact that only a very few states with small populations don't have sales tax.I'm not attempting to make you lose face. It was simply a misunderstanding.

My 'b)' statement:

I'm not sure how the statement could be valid/invalid.

State sales tax does in fact vary and I was simply asking if you know that. You keep repeating the 9.25% number as if it is the number instead of a number, but instead of assuming () that is what you meant, I asked.

Also, iirc, Oregon and New Hampshire have no sales tax.

Checking wikipedia, Oregon and New Hampshire have no sales for everything except a category called "prepared food" which are taxed at 5% and 9% respectively.

Well, your example is correct in that your example does show the "richer" people paying more relatively to the poor in terms of a burden. But there are a couple of things which I think makes your particular example not applicable to the reality of the country as a guideline for tax policy.I think you're logic is a bit off as far, far more people contribute to that 30% pool than to the 27% one.

For example, if you have 500 people who earn $10 a year who have to pay 30% of a $1000 tax burden and 5 people who make $100 who have to pay 27%, members of the 500 pay .60 cents each and the 5 people have to pay $54 each.

Math is not at all a personal strength, so that little equation could be the 'ah ha!' moment you've been looking for.

1. In your example the rich are making only 10 times more than the poor, whereas in reality the top 1% are making at least 18.9 times more from your chart, at the bare minimum, the realistic number would probably be 25 times more.

2. The burden is still more on the poor than the rich.

Say there is a middle class man making $50,000 and a rich man making $1.5 million. Let's say for simplicity that the poverty line for a single person is $14,000.

14,000/50,000= 28% so the middle class man has 28% of his income going to surviving.

14,000/1,500,000= .9% so the rich man has .9% of his income going to surviving.

Now lets say in order for both men to contribute their amount, that the middle class man only has to pay 15% of his income because there are lots of middle class people. The rich man has to pay 33% of his income because there are much fewer rich people.

50,000-15% is $42,500

14,000/42,500 is now 32.9%. The middle class man now has surviving necessities taking up 32.9% of his (remaining) money. The ratio has increased by 4.9%.

1.5 million-33% is 1 million.

14,000/1,000,000 is now 1.4%. The rich man now has surviving necessities taking up 1.4% of his (remaining) money. An increase of .5%.

So even when you have the rich paying a lot more per person than the middle class or poor person, the burden is going to be bigger on the middle class man than the rich man unless you drastically up the taxes on the rich to make it more equal. This is why a few rich people paying a lot more than millions of middle class people is not a bad thing.

In order for the rich man to be undergoing the same burden, the difference between the poverty line/income amount ratios needs to be the same as the middle class person: 4.9%.

For this to take place, the rich man would need to be taxed, 83% of his income, so his income goes from 1.5 million to about $241,000.

14,000/241,000=5.8% 5.8-.9=4.9% which is roughly the increase that the middle class man had to experience.

EDIT: My original error was is in subtracting 15% from the 32.9% instead of the 28% that I had calculated right before it. But even correcting for my error, the tax rate under this idealistic tax system gives a tax rate that is more than double what the top 1% already pay. If anyone wants to tell me that $241,000 for a single person is not enough to live by, feel free to give me your name, city and address and I will come by tochill in your mansioninspect your house's structural integrity for free.

I see, my mistake than.I haven't taken the position that the rich should pay less taxes, only that the Bush tax cuts were not exclusively for the rich and were, in fact, favorable to the poor.

Perhaps, I need to look at the numbers again to double check that. Capital gains taxes are always overlooked when talking about the amount of money that the rich pay in taxes. If capital gains taxes are increased again, the burden might be more on the rich than the poor.Obviously those who pay more taxes are more sensitive to changes in the tax code either way. Strike's initial post seemed to imply that the GOP was proposing hurting the poor in favor of helping the rich. My whole involvement in this thread has been to argue that 'leaving the Bush tax cuts', as he put it, in fact helps the poor. And if we are going to use the marginal value of a dollar argument that the progressive tax system is based on, removing the Bush tax cuts will hurt the poor far more than the rich.

Last edited by a completely inoffensive name; 04-23-2011 at 06:00.

LOLOLOL, made huge calculation error. need to fix.

While this might be true in theory, good luck trying to collect 83% of his income. This will cause a massive capital flight out of the country. I believe that although the Bush tax cuts were bad, taxing anyone 83% is about the worst thing you can do.For this to take place, the rich man would need to be taxed, 83% of his income, so his income goes from 1.5 million to about $241,000.

Days since the Apocalypse began

"We are living in space-age times but there's too many of us thinking with stone-age minds" | How to spot a Humanist

"Men of Quality do not fear Equality." | "Belief doesn't change facts. Facts, if you are reasonable, should change your beliefs."

Yes, I agree about that. Taxing 83% is much too high for people's taste nowadays. But this information shows that in order for taxes to get near to "fair" we must break the silly notion of never having taxes above 50% out of some weird "last stand" to make sure that government isn't taking more than half of someones "hard earned" money.

I feel that a more reasonable tax rate for the rich lies in between the 35-40% nowadays and the 83% I calculated. I think 60% would be a good middle ground.

we taxed the rich successfully in the past, but it can't work now because

Last edited by jabarto; 04-24-2011 at 23:40. Reason: too snarky

Bookmarks