I'm not sure those stats actually reinforce the point you're trying to make.

Lowering the tax burden on people and businesses increases retained wealth, which in turn broadens the tax base, compounded each year. (Obviously this has limits at the margins.)

Let's take your numbers and assume all millionaires earn only $1,000,000.

1961: (15,753 * 1,000,000)*.43 = 6,773,790,000

2011: (361,000 * 1,000,000)*.23 = 83,030,000,000

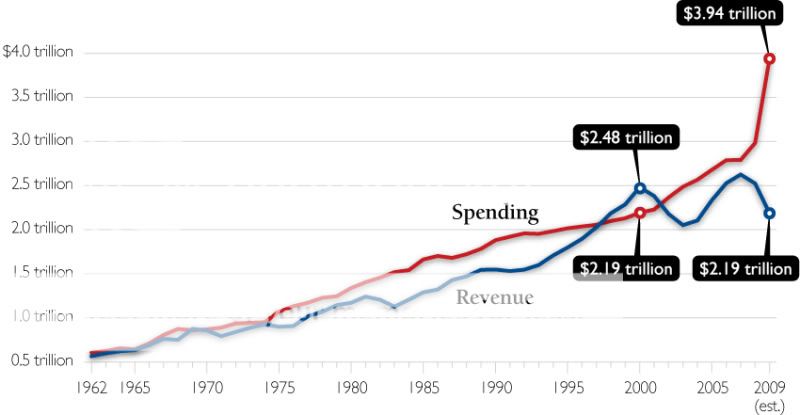

Thus, lower taxes on more people yields higher revenues, as can be seen in the chart below.

US tax policy from Kennedy to Bush II generally pushed rates down while revenues rose. Even after the much belied Bush tax cuts, the compounding effect was already starting to increase revenues dramatically (over the Clinton years) before the financial crisis.

Reply With Quote

Reply With Quote

Bookmarks